Can your corporate lawyer assist with your ? Perhaps. Does your corporate lawyer have experience collaborating with other professional advisors and working with privately held business owners on the various issues involved in the exit planning process? I wanted to find out why business owners should have a lawyer on their exit planning advisor team, in particular to understand: a) how to select an appropriate lawyer; and b) what the lawyer’s contributions to the exit planning process will b...

A seasoned M&A professional with experience selling similar businesses can help with , finding potential buyers, managing the entire sale process and representing you in negotiations with potential buyers. I recently sat down with Don Hilton, Founder and Managing Partner, of Distinct Capital Partners Inc. (www.distinctcapitalpartners.com) in Toronto, Ontario. Distinct Capital provides investment banking, corporate finance and advisory services to shareholders of owner operated businesses ...

Will the next generation want to carry on the business after you are gone? If so, are they capable? How many family members are dependent on or involved in the family business? Will the ? How about the third? Is a third party sale to a financial or strategic buyer an option? If these questions have crossed your mind, you may benefit from having a discussion with a family business advisor experienced with best practices that can make a significant difference to both your business and family in...

An independent business valuation is critical to your exit planning for many reasons. After identifying your goals and determining your financial needs, a current business valuation is t. Other independent sources also recognize the importance of a business valuation in exit planning: "At present, being able to measure the value of the business is a critical aspect of the business succession plan." CFIB Research, November 2012 "It is important to get a professional business valuation, since o...

In any negotiation, being the person who makes the first move usually puts you at a slight disadvantage. The first-mover tips their hand and reveals just how much he/she wants the asset being negotiated. Likewise, when considering the , it is always nice to be courted, rather than being the one doing the courting. The good news is, the chances of getting an unsolicited offer from someone wanting to buy your business are actually increasing. According to the Q2, 2014 Sellability Tracker ana...

According to a Canadian Federation of Independent Business (CFIB) study, nearly two thirds of companies consider their accountant (and lawyer) the most valuable source of information. [1] In 2009, the CEO of the Canadian Association of Family Enterprise (CAFE), Lawrence Barns, was quoted as saying "When family businesses are asked who their most trusted adviser is, 73% say it is their accountant." [1] Does this include you? Is your accountant your most trusted advisor? Is he/she aware of w...

A few weeks ago a friend of mine was telling me about a new exercise routine he had been following to help him lose weight and improve his overall health. It was visually apparent to me that he had achieved success with this new program. When he showed me his progression through weekly photos of himself, however, I immediately bought into his exercise routine as well as his commitment and motivation to its success. More recently, my brother sent me a current photo of himself and one from one ...

All business owners will one day – voluntarily or involuntarily. Insurance is a vital tool for ensuring you are prepared for an involuntary exit due to death or disability.

Two of our recent files at VSP involve a shareholder death. Our valuation expertise was required in connection with a buyout of the surviving spouse’s equity interest. Thankfully life insurance w...

Are you on track to meet your business goals for 2013? What are your goals for 2014? How often do you actually write down your goals for the coming year? I find that business owners generally do have predetermined revenue and/or profit targets. While those are important, there is another goal that can have an even bigger payoff: . You may say that you are not ready to sell. That’s not relevant. Here are five reasons why building a sellable business should be your most important goal, reg...

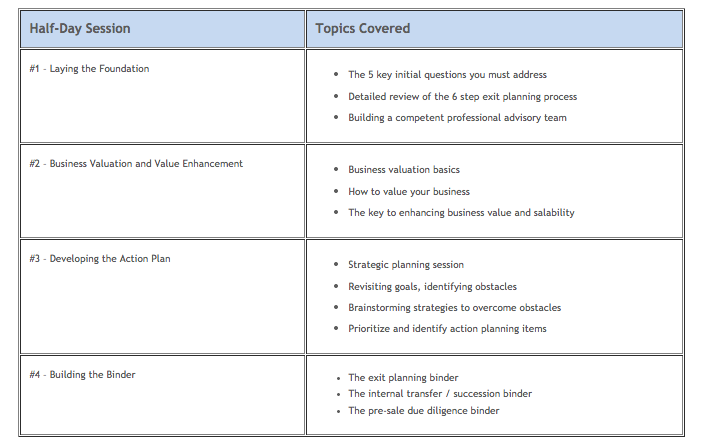

Are you in the coming decade? Have you started preparing for a successful internal transfer (e.g. family, management, employees, shareholders) or an open market sale to a third party? Do you want to maximize your net sale proceeds and achieve your goals when you exit? Do you want to be prepared in the event of a forced exit due to disability, divorce, dispute or death? If these questions don’t concern you then read no further – this program is not for you. If, however, these questions ha...