Proper preparation will greatly increase your chances of maximizing the net sale proceeds when you sell. Although preparation takes time, effort and attention, the benefits of planning far outweigh the costs. "Built to Sell" author, John Warrillow, discusses two such benefits in his recent blog entries (). A takeaway from reading John’s recent articles is that proper preparation will greatly improve your chances of: i) selling for a significant premium; and ii) avoiding buyer trickery. Let�...

The beginning of a new year is a time of rebirth and resolutions. It is a time to reflect on last year’s achievements and to set goals for the coming year. Some people set personal goals like losing weight or quitting a nasty habit, and most business owners set business goals that focus on hitting certain revenue or profit targets. If your goal is to own a more in 2014, you should select one or more of the following New Year’s resolutions: 1.Take a two-week vacation without ch...

As we approach the beginning of a new year I reflect upon our firm’s achievements and challenges over the past year. Celebrating accomplishments and monitoring progress towards goals are vital to your continued focus, commitment and motivation. How did your business do this year compared to your original goals? Are you on track to exit your business at a time of your choosing? Has your over the past year? Would you like to double the value of your business within a two year period? It may ...

When is the ? This can be a difficult question to answer. In Deciding to Sell Your Business by Ned Minor, Mr. Minor suggests that you should sell your business "at the point when you achieve your definition of financial independence." I encourage business owners to consider timing from the perspective of: i) the business owner; ii) the business; and iii) the market. In a perfect world, each of these will be in alignment when timing the sale of your business. Let’s consider each in turn. ...

Growth is a . A well documented growth story with a positive outlook for continued future growth (i.e. a sound growth plan) is very appealing to a potential purchaser. Having a competitive advantage in your industry is another key value driver because providing something unique or proprietary is extremely attractive to a potential buyer. Together these two value drivers create the perfect storm for enhancing value. Researchers at the Sellability Score have recently studied the results from ov...

I recently finished an interesting book that all business owners should add to their reading list. "Deciding to – The Key to Wealth and Freedom" by Ned Minor [1] explores the notion that all business owners must first decide to sell their business before embarking on the actual sale process. Mr. Minor is co-founder of a Denver-based law firm which focuses on designing and implementing exit strategies for privately held business owners. Minor has coached hundreds of business owners in this ...

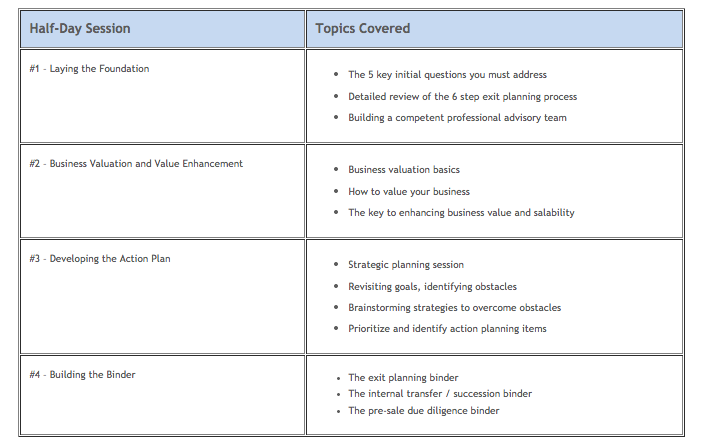

Are you in the coming decade? Have you started preparing for a successful internal transfer (e.g. family, management, employees, shareholders) or an open market sale to a third party? Do you want to maximize your net sale proceeds and achieve your goals when you exit? Do you want to be prepared in the event of a forced exit due to disability, divorce, dispute or death? If these questions don’t concern you then read no further – this program is not for you. If, however, these questions ha...

Are you on track to meet your business goals for 2013? What are your goals for 2014? How often do you actually write down your goals for the coming year? I find that business owners generally do have predetermined revenue and/or profit targets. While those are important, there is another goal that can have an even bigger payoff: . You may say that you are not ready to sell. That’s not relevant. Here are five reasons why building a sellable business should be your most important goal, reg...

All business owners will one day – voluntarily or involuntarily. Insurance is a vital tool for ensuring you are prepared for an involuntary exit due to death or disability.

Two of our recent files at VSP involve a shareholder death. Our valuation expertise was required in connection with a buyout of the surviving spouse’s equity interest. Thankfully life insurance w...

Jeff Ambrose, CPA, CA of Valuation Support Partners interviewed for an article authored by Peter Merrick in The Bottom Line entitled "The Tricky Business of Pre-Mortem Valuation"