When is the right time to sell your business? This can be a difficult question to answer.

In Deciding to Sell Your Business by Ned Minor, Mr. Minor suggests that you should sell your business “at the point when you achieve your definition of financial independence.”

I encourage business owners to consider timing from the perspective of: i) the business owner; ii) the business; and iii) the market. In a perfect world, each of these will be in alignment when timing the sale of your business. Let’s consider each in turn.

1. The business owner – when will you be ready to sell?

To help answer this question, ask yourself if you still have the same level of energy and passion you once had for your business. You should also address what you plan to do after you exit your business. Only you will know when you are emotionally and psychologically ready to leave your business.

Keep in mind that your age, energy level, passion, health and willingness to stay on after a sale can impact the value of your business. In many cases, holding on too long can serve to reduce the value of your business.

Ideally, you should sell just before the point in time when your passion and energy level for your business begin to wane.

2. The business – when will your business be ready to sell?

A proper plan is necessary to ensure that your business will be ready for sale when you are ready to exit and the successful implementation of this plan will take time – at least 3 years.

To ensure your business is ready for sale at its peak value you should assemble a pre-sale diligence binder that provides all information necessary to ensure a smooth sale process. To maximize value, this binder should show, among other things, a track record of steady growth (i.e. for at least 3 years) and a business plan setting out how you will achieve continued growth. Showing a buyer that there are high barriers for potential competitors because of your industry niche, competitive advantage or proprietary technology will go a long way towards commanding a premium price.

Ideally, you should sell your business after a period of steady growth (i.e. at least 3 years) and just before a plateau. This creates the allure of future growth which drives up value.

3. The market – when will the market be ready for you to sell?

With proper planning, you can have some control over 1 and 2 above. The market, however, is one thing you can’t control and its future is inherently uncertain and unpredictable. Keeping up with the level of activity in your industry can help you time your sale. Speak with others in your industry, read trade journals and industry publications, join an industry association, speak with valuators and M&A professionals to get sense as to how hot or cold the market is in your industry.

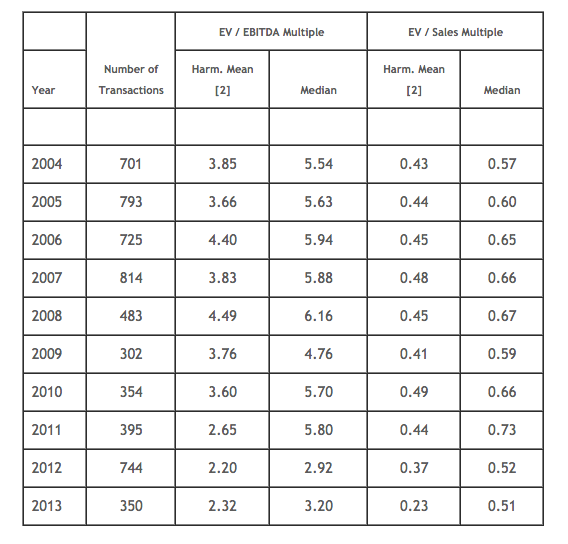

Markets can be volatile with high peaks and low valleys. Ideally, you want to sell at a peak when demand and market multiples are high. Clients often ask me how the markets are doing and where market multiples are compared to past years. In Canada, there is limited information on private company transactions. Looking to the U.S. as a proxy, however, and conducting a search of all transactions for companies with positive earnings reveals the following results over the past decade: [1]

It is interesting to note that average EBITDA multiples have been declining since 2008 with the exception of a slight uptick in 2013. Average sales multiples have also been trending down for the past four years and actually dropped below 0.4 times in 2012 and 2013 for the first time since pre-2004. It is also interesting to note that market activity (i.e. total # of transactions) dropped off in 2008 and, with the exception of 2012, does not appear to have returned to pre-2008 levels.

Keep in mind that this data aggregates transactions from all industries and that results will vary depending on the industry in which you operate.

In light of this trend and the expected significant increase in the supply of businesses for sale over the coming decade (i.e. some 550,000 businesses in Canada), it will be that much more critical for business owners and their businesses to be prepared. Only the most attractive and salable businesses (i.e. those that are prepared) will sell for a premium. Those that are not prepared risk selling for a significant discount or face liquidation altogether.

If this concerns you, our Exit Starter Program can help. To see if you qualify for our VSP Exit Starter Program, contact us at jason@vspltd.ca or www.vspltd.ca.

1. Source: Pratt’s Stats private company database. 2013 figures up to October 25, 2013.

2. The harmonic mean tends to mitigate the impact of large outliers and aggravate the impact of small ones.